Framework for Recognizing Cost Savings vs. Annual Operating Plan (AOP)

The purpose of creating this framework is to clearly distinguish cost savings vs AOP (Annual Operating Plan) assumption by establishing consistent principles, methodologies, and reporting practices. It ensures that only procurement-driven, substantiated savings are recognized, excludes uncontrollable factors like volume changes, and provides a transparent way to track and credit value creation beyond planned productivity targets.

We are formalizing recording and reporting of Cost Savings vs AOP from a functional point of view

Definitions & Scope

| Term | Definition |

| Annual Operating Plan (AOP) | The baseline financial plan that incorporates inflation, productivity targets, and forecasted volumes. |

| Cost Savings vs AOP | Financial benefits achieved beyond AOP expectations, driven by procurement actions, and supported by data (e.g., inflation mitigation, contract negotiations) |

| Productivity | Planned and targeted initiatives embedded in the AOP, representing expected performance improvements (e.g., supplier re-sourcing, value engineering, automation) |

| Managed Spend | Spend categories under procurement control, where sourcing, negotiation, and supplier management can influence outcomes. |

Guiding Principles

Methodology for Calculating Cost Savings

- Establish Baseline Use AOP inflation assumptions for managed categories. Procurement will document assumptions upfront when AOP is locked.

- Validate Inflation Assumptions Based on external indices or market inputs, validate and document detailed assumptions with finance.

- Identify Procurement Action Ensure cost change is driven by procurement initiative (e.g., contract renegotiation, sourcing)

- Exclude Non-Procurement Impacts Remove savings due to business-driven changes (e.g., volume, project delays)

- Document Evidence Keep audit trail for savings calculation (e.g., contacts, supplier quotes)

Reporting and Recognition

Both P&L Productivity and Cost Savings vs AOP will be recorded and reported in PowerSteering

| Metric | External Reporting | Internal Recognition |

| Productivity in AOP | Tracked and reported | Used for goal setting and performance evaluation |

| Cost Savings vs AOP | Not externally reported | Internally tracked and recognized functionally |

| Total Value Contribution | Only productivity reporting | Used for procurement team recognition and incentive alignment |

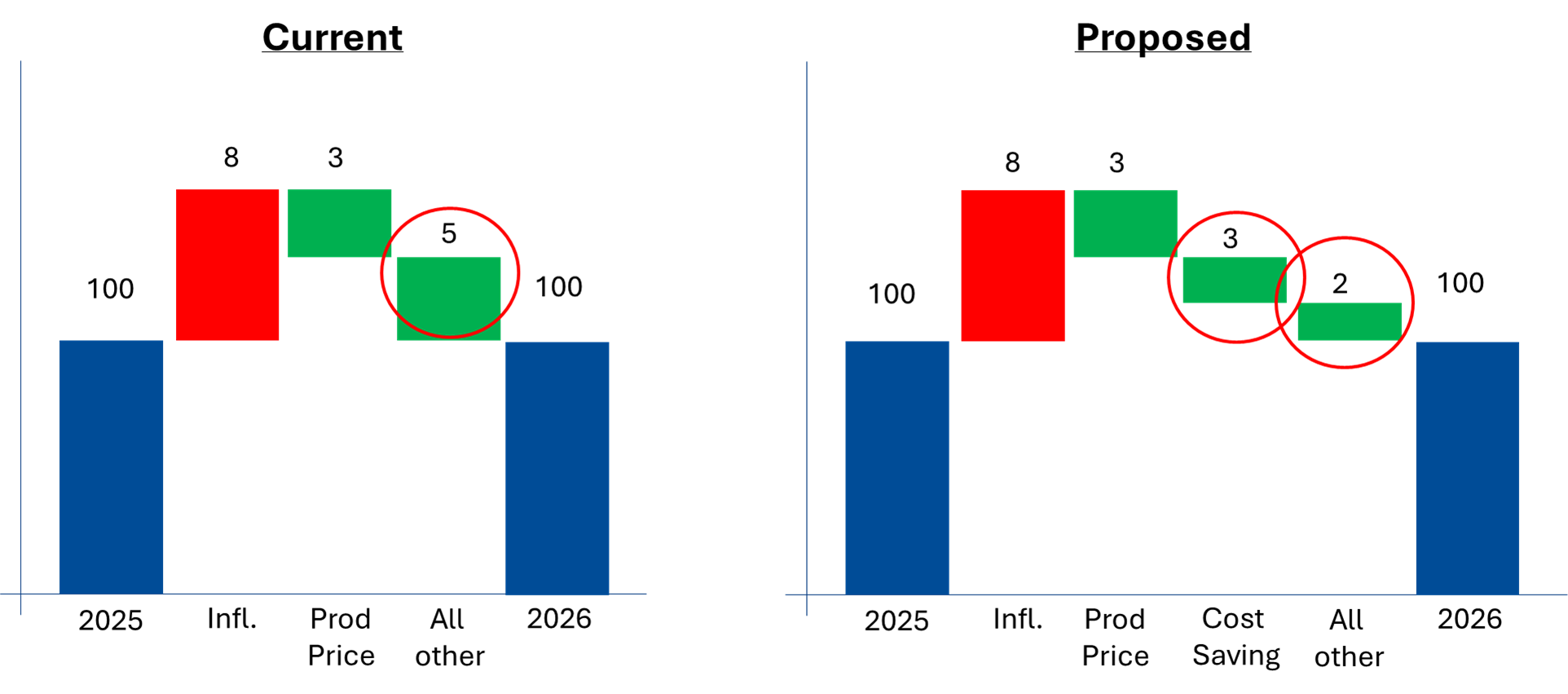

Difference between Productivity and Cost Savings vs AOP

Key defining factor is the baseline of Prior Year vs AOP. Baseline should be clearly defined and measurable to count as Productivity or Cost Savings vs AOP. Any other hypothetical measure such as reduction vs quotation from suppliers, reduction vs market rates, etc, does not have any bearing on the calculation.