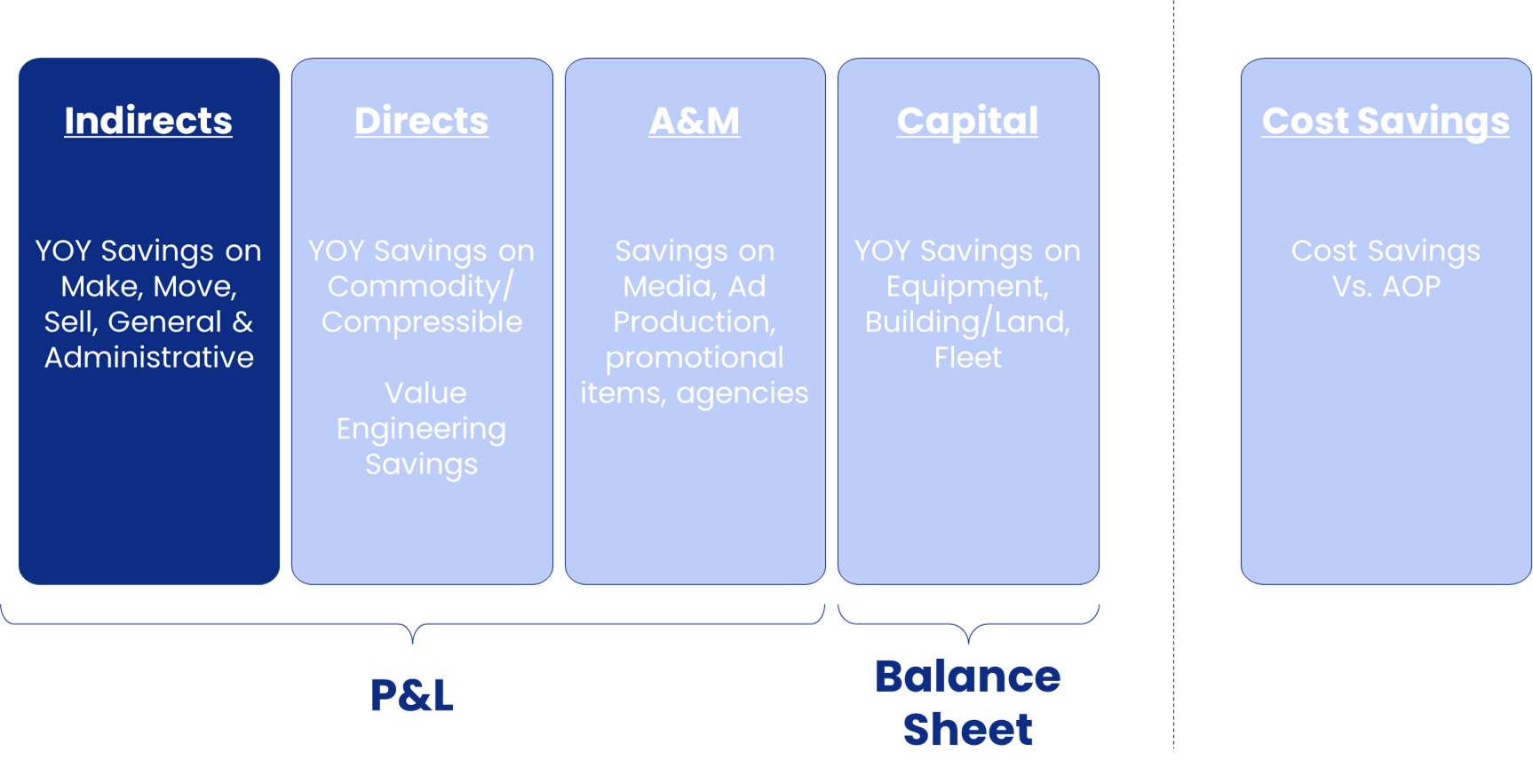

Global Procurement Areas of Reportable Productivity

Indirects Productivity Definition

Indirects Productivity refers to savings related to the costs in the Make/Move/Sell/G&A accounts. It is also referred to as "Operations Productivity" and impacts various operating expenses YoY savings amount and as a percentage of managed indirects spend.

Productivity = (YoY Change in Cost Per Unit) x (Number of Units Purchased in the Current Year)

Productivity Savings KPI is calculated as: Productivity Savings / "Managed Indirect Spend" - Current Year Productivity Savings

Prior Year Calculated Indirects Managed Spend = Current Year Managed Indirects Spend + Current Year Productivity Savings

-> Managed Indirects Spend is the segment of total indirects spend that has Global Procurement resources assigned against it.

Common Examples

- Make: Reducing the cost of cleaning & sanitation services in the plant

- Move: Optimizing outbound freight of finished goods to reduce overall cost

- Sell: Enhancing sales efficiency and profitability through optimizing rates on purchased goods and services

- G&A: Negotiating lower rental costs for offices

Key Productivity Drives

- Re-negotiating existing contracts using best practices to drive value; YoY productivity based on tangible cost reductions over comparable PY baseline (e.g., rate reductions)

- Consolidating spend across markets and regions centrally to gain leverage and drive savings

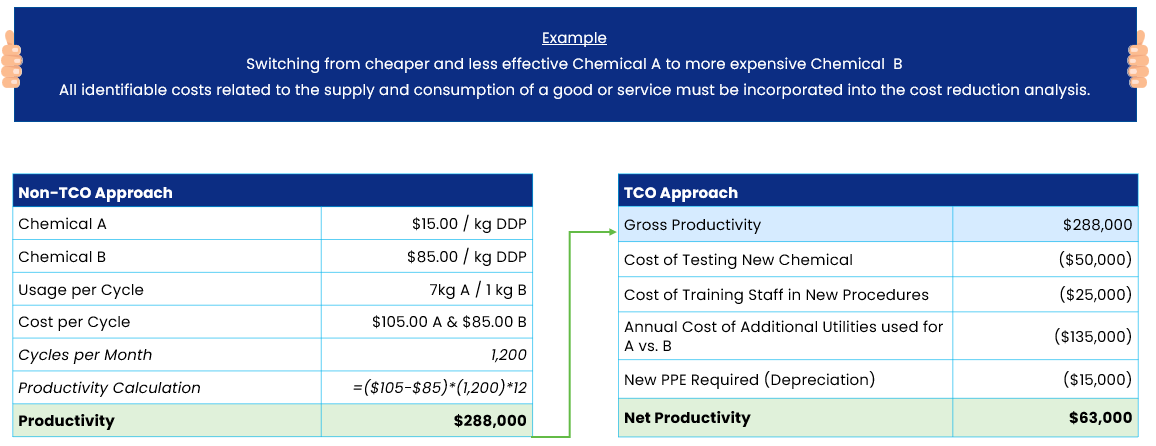

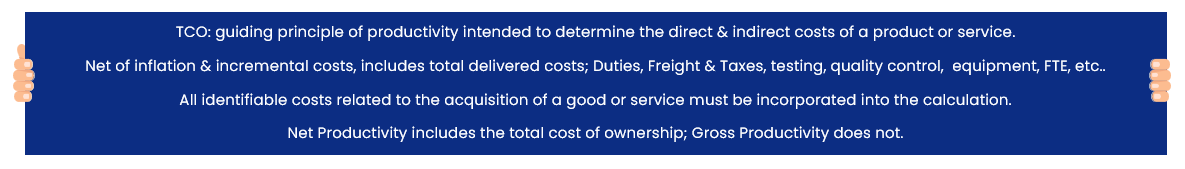

Total Cost of Ownership

Analyzing TCO

- TCO is an analysis meant to uncover all the costs of acquiring a good or service that allows to look beyond the price to include many other purchase related costs

- Calculating beyond the initial price, TCO helps make strategic decisions, avoid hidden expense, and identify the most cost-effective impact on P&L benefit

Asset Ownership

- Asset ownership entails cost of the actual purchase, but it also involves costs due to installing, deploying, using, upgrading, and maintaining the same assets; these post-purchase costs can be substantial

- For many kinds of assets, TCO analysis finds a very large difference between the purchase price and the total life cycle costs

- The difference between purchase price and total life cycle costs can be especially large when ownership covers a long time period